What hiring happened in Q3?

A Look Inside the Quarter for Technical Markets

Introduction

As we close the door on Q3, we’ve taken a detailed look at how placements were distributed across Vivid Resourcing’s core sectors: Technology, Engineering, Government, Professional Services and Life Sciences.

Across industries and regions, the data highlights shifting recruitment patterns, evolving client priorities and how our specialist teams continue to respond.. Below, we unpack the figures and offer insights from our market experts who explore the drivers behind Q3 demand – alongside early signals for where growth is expected in Q4 and beyond.

Whether you’re hiring, contracting, or simply tracking market movements, this is your snapshot of the recent quarter, and a view of what’s coming next.

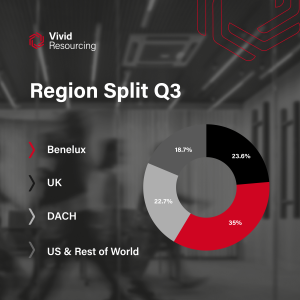

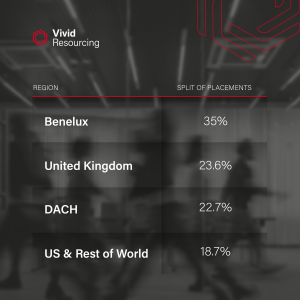

Regional Performance: Key Q3 Trends

Benelux

Mirroring Q2, Benelux remained Vivid’s strongest-performing region, accounting for over a third of all placements. As our presence across Belgium and the Netherlands has expanded, so too has hiring activity – particularly within Engineering, Technology and Life Sciences.

This growth continues to be underpinned by long-standing client partnerships, alongside new relationships driven by large-scale industrial, manufacturing and regulatory-led projects.

United Kingdom

The UK remained our second-highest performing region, although activity dipped slightly following an exceptionally busy Q2. Several clients began slowing hiring towards the end of the quarter as they prepared for January budgets and 2026 delivery pipelines, particularly within government and public sector programmes.

DACH

The DACH region held third place, increasing its share of placements compared to Q2 and now sitting almost level with the UK. We now expect DACH placements to grow even further as we expand our presence in Germany through our Düsseldorf office.

United States & Rest of World

Both regions recorded strong quarter-on-quarter growth. Following its launch in 2024, Vivid’s US office has expanded rapidly in both headcount and market presence.

Ongoing IT infrastructure modernisation programmes, alongside increasing regulatory and compliance requirements, meant Q3 was the busiest quarter to date for our US-based consultants.

In parallel, we’ve also established growing activity across Scandinavia, with consultants increasingly specialising in local hiring markets across the region.

The Specialists’ Take: What Drove Demand in Q3

Global mobility continued to shape engineering hiring across Europe.

“Local personnel are becoming harder to find. This quarter, the energy engineering market has seen increased demand for professionals able to travel across regions rather than commit to a single-country placement.”

George Foreman, Düsseldorf: German Engineering Specialist

This shift was reinforced by cross-border project delivery:

“Several German clients came to us with projects operating in Scandinavia and the Netherlands, meaning a greater share of recruitment activity was directed into these regions compared to previous quarters.”

Ben Morgan, Düsseldorf: German Engineering Hiring Consultant

In the US, infrastructure delivery accelerated:

“Over the past quarter, many East Coast organisations moved IT infrastructure projects from planning into execution. This drove increased demand for engineers able to deliver cloud, hybrid and on-prem transformations, particularly within financial services, healthcare and life sciences.”

Loui Cowles, Charlotte – US IT Infrastructure Staffing Specialist

Germany’s data centre market continued its long-cycle pattern:

“Germany remains Europe’s largest data centre hub. Projects are long-term and offer stability for freelancers, but hiring naturally fluctuates depending on project phase and delivery milestones.”

Holly Fargus – DACH Electrical Engineering Market Consultant

Meanwhile, regulatory pressure drove technology demand in the Netherlands:

“Increased regulation is leading to more compliance and security-led IT projects across healthcare, finance and government.”

Scott Combes, Amsterdam – Digital Product Owner & Project Manager Hiring Specialist

Amsterdam’s startup ecosystem remained active:

“Amsterdam continues to attract founders and early-stage businesses, strengthening demand for specialist technical talent.”

Oscar Bridgman, Netherlands – Data & AI Specialist

Belgium presented a different challenge:

“Engineering specialists in Belgium are difficult to source, particularly for roles requiring both French and Dutch. Many clients find broader agencies struggle in this market, which is why they increasingly partner with Vivid as a niche engineering specialist — particularly across food and drink manufacturing, defence and space.”

Connor Howell, Antwerp – Benelux Engineering Hiring Expert

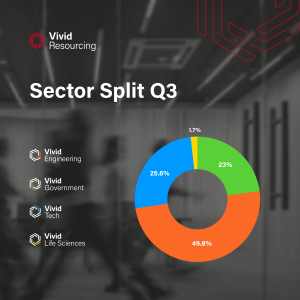

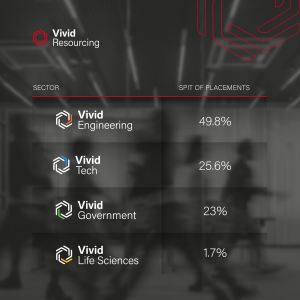

Sector Split: How Placements Were Distributed

Engineering recorded its busiest quarter to date, accounting for just under half of all placements. This was driven by new projects launching across Europe and others progressing into commissioning phases, significantly increasing demand for contract engineering support.

The gap between engineering and the next two largest sectors widened as expected, supported by our expanding EU engineering footprint and the launch of our Düsseldorf office.

Technology placements dipped slightly overall, although for the first time this financial year, technology overtook government as our second-busiest sector. Demand across Dutch startups played a key role in this shift.

Government hiring softened slightly following a particularly busy Q2, but demand remains consistently high within a structurally candidate-scarce market.

Life Sciences entered a gradual growth phase, reflecting increased consultant capacity and renewed client activity across pharmaceuticals and regulated manufacturing.

Consultant Viewpoint: Deeper Market Signals

Construction and infrastructure hotspots emerged clearly:

“Frankfurt, Groningen and Düsseldorf have become major construction hubs. Demand for site managers, planners and HSE professionals has surged, directly driving engineering placements.”

George Foreman, Düsseldorf – Engineering Contractor Hiring Specialist

Energy storage also scaled rapidly:

“The BESS market is growing at 2–3GW per year, with multi-GW pipelines targeting 2026. Staffing has had to keep pace, driving urgent contractor demand.”

Rhodri Skyrme – Germany Electrical & Software Market Expert

“Most solar companies are now focusing on BESS projects. It’s a young, highly competitive market, and experienced specialists are scarce.”

Ally Freeman, Düsseldorf – Head of Solar Construction & Scheduling Personnel

Across Benelux, skills shortages persisted:

“There’s a clear shortage of D365 professionals across Wallonia, Limburg and Groningen, driven by long-standing regional skill gaps and sustained demand.”

Alexander Loft – .NET & Benelux D365 Expert

Energy security influenced hiring:

“Investment in LNG short-term and hydrogen long-term infrastructure is accelerating, creating demand across EPC, commissioning and HSE.”

Luke Burgess, Germany – Contract Engineer Specialist

The UK Legal industry experienced a busier quarter:

“In both public and private sectors the market is busier than it has been in recent years. Local Government Devolution deals are leading to council mergers and structural changes. With permanent recruitment becoming increasingly difficult during this period of uncertainty, interim professionals are being relied upon more than ever to provide stability and continuity.”

Joe Blashill – Locum UK Legal Recruitment Team Lead

The UK Housing market experienced regulatory changes:

“The UK Renters Reform bill has passed which will affect housing markets. It will now be harder to evict tenants from April, so should lead to less private sector housing in the short-term. This could lead to an increase in supported housing requirements.”

Oscar Bennison, Interim UK Housing Personnel Specialist

The Road Ahead: Q4 and Beyond

Looking forward, several themes are already emerging:

“Projects launching outside core operating regions – particularly around Groningen and Frankfurt – will drive a noticeable increase in DACH placements moving into Q4.”

George Foreman, Germany – Engineering

In the US, planning cycles are shaping demand:

“US organisations are reassessing skills gaps as they plan AI integration alongside legacy systems, which will continue to drive infrastructure hiring.”

Aman Padam, US IT Infrastructure Staffing Consultant

Competition for talent is expected to intensify:

“Severe skill shortages mean higher rates, longer contracts and greater flexibility will be required to secure specialist engineers.”

Rhodri Skyrme, Germany – Software & Engineering“An increase in private equity deal activity in Q3 is beginning to shape hiring trends across finance functions. Based on last quarter alongside rising demand we can also expect greater candidate supply, leading to more competition and a more selective hiring process.”

Joshua Davis, UK – Private Sector Finance & Accounting Specialist

Skill demands are shifting:

“From a hiring perspective in the Netherlands, demand in IT Infrastructure is highest for SAP S/4HANA professionals across Finance, Logistics, and Supply Chain, as well as consultants who can support integrations and complex transformation projects. Experience in change management and end-to-end delivery is increasingly valued.”

Andrej Djuretic, Amsterdam: IT Infrastructure Hiring Expert

Many Dutch firms will likely invest in AI-enabled modules for analytics, automation, decision support, and other data-driven tasks. This will boost demand for software vendors offering AI/ML, analytics, or data-ops tools – following a boost in new AI tools and push for efficiency.

Scott Combes, Netherlands IT

“Within Town Planning staffing urban regeneration, residential, and commercial sectors remain especially busy, and upcoming grid connection dates are likely to drive increased demand for planners with renewable energy experience. As a result, I anticipate it to remain a naturally candidate-short market, placing ongoing pressure on consultancy capacity and project delivery.”

Joe Senior, UK – Private Sector Town Planning Payroll Hiring Consultant

Across Belgium, we are beginning to see QA/QC Specialist demand within Pharmaceuticals picking up again after a year of lull which resulted from a post-pandemic landscape.”

Connor Howell, Benelux Engineering

Early commitment will be crucial:

“Clients who secure candidates early will access the strongest talent, particularly on complex electrical projects requiring native-language expertise.”

Holly Fargus, Germany – Electrical Engineering

Conclusion

Q3 reinforced a clear pattern across Vivid Resourcing’s markets: projects are becoming larger, more regulated and more delivery-driven. As organisations move from strategy into execution, demand for specialist, mobile and immediately effective talent continues to rise.

As we enter Q4, the strongest outcomes will come from early engagement, specialist knowledge and precise alignment between talent and project needs – principles that remain central to how we support clients and candidates across Europe, the UK and the US.

We’re here to help

- If you’re a manager needing assistance with your current or future hiring needs, contact us to be put in touch with a market expert.

- Have a question? Find out more about the services that can help you here.

- Looking for more insights? Check out the latest news.